Today, numbers for new home sales came in low at 468K. The estimate was for a more healthy 549K. In August I had warned of a decelerating trend for new home sales because revisions were coming in lower and lower. But this was ignored by a lot of housing pundits.

New Home Sales Need A Strong Report

http://loganmohtashami.com/2015/08/19/new-home-sales-need-a-strong-total-report/

We are still tracking for year over year growth but this is primarily due to the very low sales in 2014.

From Calculated Risk

http://www.calculatedriskblog.com/2015/10/new-home-sales-decreased-to-468000.html

To put these numbers in context, the last time new home sales numbers were this weak (adjusting to population) was back in the early 1980’s when the US was in a recession and mortgage rates were in the double digits.

From Doug Short

http://www.advisorperspectives.com/dshort/updates/New-Home-Sales.php

“New single-family home sales are about 7% below the 1963 start of this data series. The population-adjusted version is 54% below the first 1963 sales and at a level similar to the lows we saw during the double-dip recession in the early 1980s, a time when 30-year mortgage rates peaked above 18%. Today’s 30-year rate is around 4%.”

Despite all this data, we still hear the same myriad of excuses for the low numbers: ie… lack of inventory, worker shortage, it’s too cold, it’s too hot, it’s football season.

What you don’t often hear is the real reason – there is a lack of demand because new home are very expensive and new home purchases are primarily (90%)from the mortgage market. Existing home sales, on the other hand, are a mix of cash ( Cash 25% equating to 1,000,000 + homes) this is 15% above historical norms for cash buyers on exiting homes.

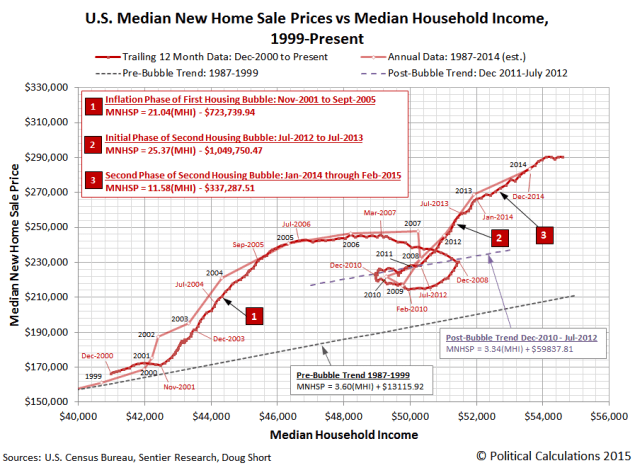

Median new home prices in 2015 have been relatively stable, but are still, slightly above the housing bubble peak, when adjusting to inflation. On a nominal basis they’re well above the peak of 2006. The high prices are primarily due the fact that home builders are offering larger, more luxurious homes, rather than building for the first time home buyer.

http://politicalcalculations.blogspot.com/2015/10/more-sideways-with-us-new-home-sale.html#.Vi48rX6rSUk

We can expect and uptick in home sales simply due to the fact that current numbers are so damn low. In a few years, the demographic economics in the US will improve for housing and we can expect to see much better sales activity. For now, however it will continue to be slow and steady growth instead of Housing Nirvana.

Final fact, if anyone dares to tell you that sales were low due to a lack of inventory!

“The seasonally adjusted estimate of new houses for sale at the end of September was 225,000. This represents a supply of 5.8 months at the current sales rate”

6 months is considered a balance market place, this came from census with the new home sales report today which is below.

From Census

Click to access newressales.pdf

Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1988 and is in a partnership with ZeneHome.com