In my 2015 and 2016 housing and economic prediction articles I talked about the 10 year yield and the lower level of 1.60% being the crucial level.

Even with the Fed raising rates and talking about about raising rates further, it still didn’t change my core thesis on long term rates here in America.

2016 Housing & Economic Prediction Article:

“Yes, that is 1 handle on the 10-year even with the Fed starting their rate hikes. I predict long term rates will remain low due to demographic deflation (more on this later), unless ECI wage inflation and CPI core inflation rise.”

https://loganmohtashami.com/2015/12/28/2016-housing-economic-predictions/

For weeks now on another financial website which I do weekly predictions on mortgage rates, which in real terms is a 10 year yield discussion, I talked recently about this key tight channel that we are in between 1.70% – 1.90% for the U.S. 10 year.

Today, as global yields fall once again and negative rates are abound, we have broken that lower level of 1.70% on 10 year, with a 1.66% 10’s 10:09 am pricing 06/09/2016

The low point in closing yields recently, for the U.S. has been 1.64% in both 2015 and 2016 which just a touch off from my key level of 1.60%

The big difference is that global yields are falling once again even though core inflation and ECI wage inflation has been picking up here in America since 2015.

Bretexit is the key factor in the recent drama coming out of Europe. For the record I am looking for them to stay with a 57% Yes vote.

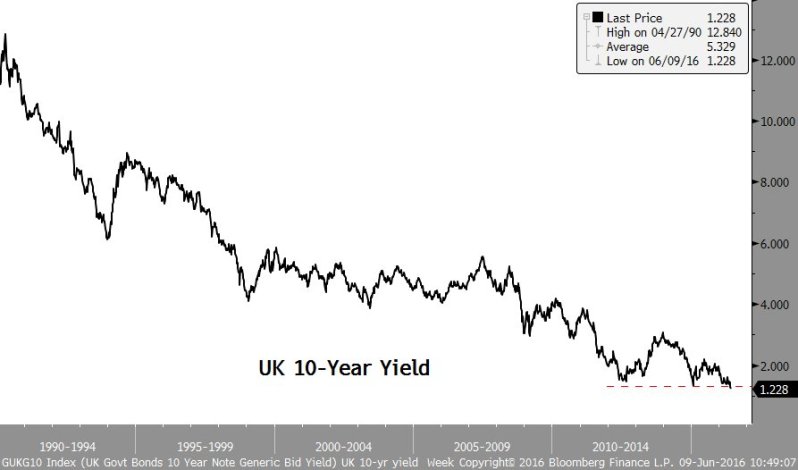

A look at bonds from one of the “all must follows” on twitters:

US yield breakdown directly follows what’s happening in UK, Germany, w/ Gilt yield breakdown to new lows, Bunds 3bp!

Treasury yields breaking down globally- $TNX under 1.70 this morning while 30-year has cracked 2.50, following UK

New all-time low today in UK 10-year yield: 1.22%

The negative yield matrix getting redder by the day…

New 52-week lows in 10-year yields today in most of Europe, South Korea, and Australia. The race to negative yields.

So what now?

If the 10 year can close under 1.60% and get next-business trading day follow through action, then look for us to go back to the 1.35% level on 10’s.

Be mindful this is more of a story on the world economics then U.S. Low yields aren’t an issue for us or the housing market place. Clarity on BretExit, yes vote, could send yields higher short term.

However, I have to respect trend here. The world global yields are taking the U.S. lower with it, so this global fall in yields could break my key line of 1.60% that has held up so well.

Note: For today’s actions you need to see a close under 1.70% and next day follow up action to the downside on yields to get a clean break. Yield slippage on the outer bands on 10’s is very common.

Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987.