The portion of my interview starts around the 32:00 minute mark. The article below highlights some of the miserable recession calls of the past 8 years.

When French writer, Jean-Baptiste Alphonse Karr quipped plus ça change, plus c’est la même chose,(the more things change the more they stay the same), in 1849, he could have been prophesying about the US housing market for the past six years, (okay that’s a stretch). It’s a fact, though, that what I wrote six year ago: “We simply don’t have enough qualified home buyers in America, once you excluded the cash buyers, to have a real housing recovery,” remains true today. Housing demand remains light in year 8 of the expansion. Historical charts on mortgage demand, new home sales and monthly inventories, flesh out the story.

Mortgage demand is at the same level it was in 1998 when interest rates were 4% and higher.

Calculated Risk:

http://www.calculatedriskblog.com/2016/07/mba-mortgage-applications-increase-in.html

New home sales in year 8 of this cycle, are at the same level as they were during the recession of the 1980’s when mortgage interests rates were north of 14% .

From Doug Short

http://www.advisorperspectives.com/dshort/updates/New-Home-Sales

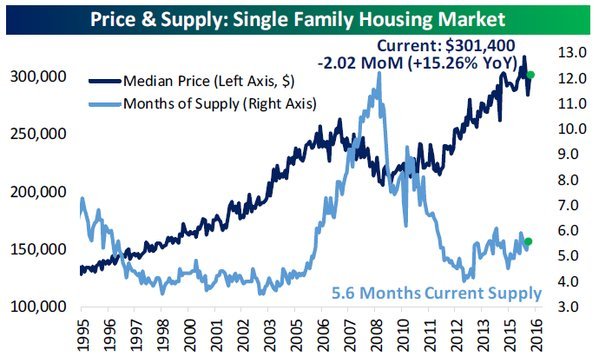

Today monthly inventories of homes on the market are higher than any period from 1999-2005, giving lie to the low inventory excuse for weak sales.

https://loganmohtashami.com/2016/04/08/low-housing-inventory-lie-still-lives-on/

@georgepearkes

US demographics help to explain why we are stuck at 2% GDP growth and a soft housing market. The US prime age labor force growth peaked in 2007 and is slowly growing again. But right now our population is on either end of the bell curve –too young and too old, to drive the economy.

Young people spend! Older people don’t!

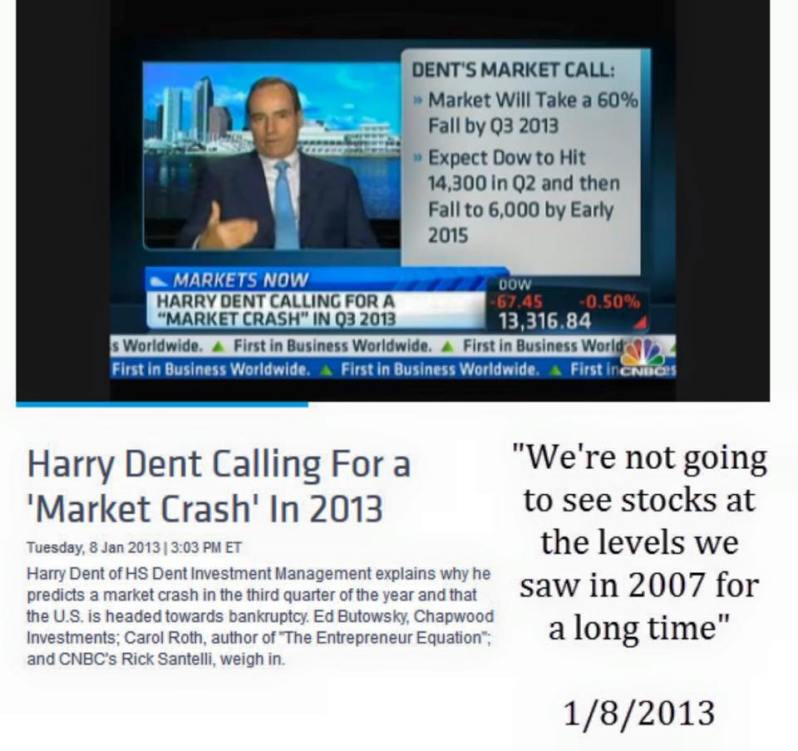

With that said, however, I am not joining the chorus of recession bears. To put it bluntly, these guys are, and have been, just wrong. There are many well-known names in this sorry club, too many to list. But just for fun, here are a few of my favorite bad calls:

1) Harry Dent predicts an economic collapse in 2013 ,2015 and 2016:

2) Peter Schiff predicts the dollar will fall and gold will go to $5000:

Peter Schiff has also called for a American collapse in 2016. But gold never got to 5,000 and the dollar rose in 2014/2015 creating a commodity crash. O0ps!

What really happened since the bottom of the stock market in 2009, is that stocks are up 219.8%

From Doug Short:

http://www.advisorperspectives.com/dshort/updates/Market-Snapshot

Instead of collapsing the dollar rallied.

From @MktOutperform

3) Mike “Mish” Shedlock in 2011 says the US is currently in a recession

Monday, August 29, 2011 2:54 AM

US In Recession Right Here, Right Now

I am amused by those who think a US recession will come within a year. Even more amusing are those who think a recession will not come at all.

“The US is in a recession now. I am not the only one who thinks so.”

Mike looks like he is laughing here. Maybe it was supposed to be a joke?

Let me take this opportunity to remind Mike and the other recession callers that a true recession requires certain things to occur. First, we need over investment that creates a supply and demand imbalance in the economy which in turn creates demand destruction leads to a recession. I am not talking about just two negative GDP prints either. We also need a cycle where unemployment claims rise as companies lay off people to keep their stage budgets manageable. When unemployment claims gets to a 323K, 4 week moving average with breath, then we can start talking about a U.S. recession.

But, unemployment claims have never broken come near this level, despite weakness from Europe, Japan, China, Brazil and many other countries since 2011. Even with the oil and commodity collapse, we never broke higher on unemployment.

From Dough Short:

http://www.advisorperspectives.com/dshort/updates/Weekly-Unemployment-Claims

What we have instead is over 154 million working Americans, a 43 year low in unemployment claims and ECI wage inflation rising with all inflationary data ECI wage inflation tracker is running at 3.6% and 4.3% for job switchers.

We will eventually see a recession in the US. So if these doomsayers stick to their whining they will eventually be right. Today however, they need to explain why retail sales are at cycle highs, home sales are at cycle highs with the highest mortgage demand and that over 100 million cars have been bought over the last 8 years.

From Calculated Risk:

http://www.calculatedriskblog.com/2016/07/retail-sales-increased-06-in-june.html

Lastly, these doomsayers may say that recession is eminent because Americans have too much debt. What they have failed to realize is that, typically, those of us who have the highest nominal debt, are also those with financial assets. As you can see below, the majority of all household debt are mortgages backed by homes. In this cycle, unlike the last one, buyers have the capacity to own the debt of a home, unless there is a job loss.

Plus ça change, plus c’est la même chose. Although the details may change, these doomsayers are still peddling the same malarkey since 2009. I only ask that you look at the data and make up your own mind.