Certain old saws that fuel the predictions of economic pundits should periodically be tested to determine if they maintain their predictive accuracy. Three such the old school rules that are heavily relied upon to predict and explain housing economics are the following:

1. When employment is high people buy homes

2. When interest rates are low people buy homes

3. When rent inflation is high people buy homes

Shelter is a product that millions of Americans will purchase each year, but what economic factors cause growth or decline in the purchase of this product? If high employment, low interest rates and high rent inflation, three factors that are present in today’s economy, stimulate the purchase of this product, then why has the level of growth in mortgage home sales this 8 year economic cycle disappointed many housing pundits and experts?

I give them (minor) credit that they no longer blame tight lending. That completely unsupported thesis has finally succumbed to a slow and painful death. The new “stalking horse” that has replaced tight lending as the favorite unsupported thesis to explain the low sales numbers, is tight inventory. According to the “experts” we simply don’t have enough homes to address the high demand.

In a previous article “Low Housing Inventory Lie Still Lives On”

https://loganmohtashami.com/2016/04/08/low-housing-inventory-lie-still-lives-on/

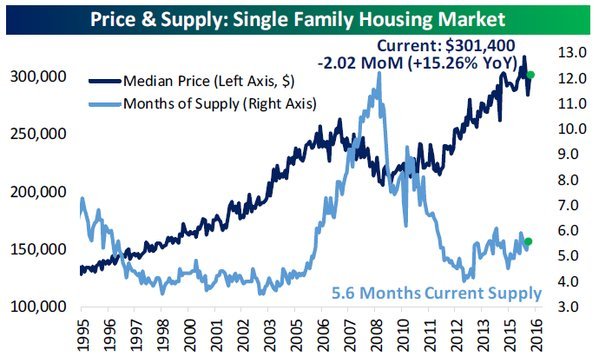

I discuss and document with data, that existing home sales inventory ( annual months) was slightly higher in 2012-2016, the period of supposed low inventory, than in the period of 1999-2005, when housing sales were exploding. In other words, if it is low inventory that is preventing growth in sales, why are sales lower in a time when inventory is higher than it was when sale were higher?

One of the problems with buying into the low inventory thesis is that what follows from this is the assumption that if builders build more homes, we should see purchases increase. And because supply has increased, home prices should be more affordable.

The obvious problem with this thesis is that builders are not building starter homes. For the past four decades, in fact, builders are building bigger and bigger homes and flooding the market with higher prices homes for the wealthy. This will not do anything to make homes more affordable for the rest everyone else.

If you need proof of this, look behind you. We already ran this experiment. Did the ramp-up in home building from 1994-2007, especially the massive over building from 2002-2006, make housing cheaper?

From Doug Short:

http://www.advisorperspectives.com/dshort/updates/Housing-Starts

Adjusting to inflation, home prices were more expensive during the housing bubble years, when new homes were flooding the market. More new homes didn’t and do not create housing affordability.

It might be the case that if builders were to build starter-homes that could compete in price with existing homes, than overall home prices inflation can cool down. But this is a fantasy scenario that has virtually no chance of happening. Builders have universally determined that the starter-home market is not where the profits are.

Bigger homes mean bigger profits. In 1975 the median size of a new home was 1,500 sqft. By 2016, the median size of a new home had increased to over 2,500 sqft. There has been a larger inventory of new homes in 2012-2016 than anytime from 1999-2005 but fewer yearly sales

@georgepearkes

From Doug Short:

http://www.advisorperspectives.com/dshort/updates/New-Home-Sales

I think we can let go of the idea that if the builders build more homes, then somehow, homes overall will be more affordable. It’s an idea that helps the builders sell stock but otherwise has no inherent value.

We have a permanent housing inflation problem that started four decades ago and will not be easily cured by dithering with the inventory of larger homes. Bigger homes for smaller families, for the sake of profit margin, has created this forever housing inflation issue.

We are almost running out of room to where using the thesis that lower rates will boost future housing demand. This housing cycle has had the lowest rate curve ever recorded post WWII for a long duration period.

I don’t blame the builders for not building more. I give them kudos for knowing that demand is too soft to push for more aggressive building.

Having said that, I believe that housing starts do have legs, because these numbers are coming up from the lowest levels ever recorded in U.S. history.

The additional factor to consider is the massive demographic bolus of younger Americans that will soon be coming of age to buy homes. They will choose between less expensive existing home available in all geographical areas or more expensive new homes clustered in a certain areas of a city.

To my friends in the housing analytics community, the affordability index that is commonly used assumes a 20% down payment and a starting debt to income ratio of 25%. These numbers for this metric is outdated. The likelihood of a first time buyer or a move-up buyer of having 20% down, no revolving credit card debt and no auto debt is very low.

Mortgage rates could fall by as much as 2% in the next economic cycle, making the 30-year rate 1.25% – 2.25%. If this doesn’t happen then we will have broken a multiple decade streak of having 2% lower rates in each new housing cycle. If it does happen we can expect another mini-boom of refinancing but how much it will help home purchasing is unclear.

It is unlikely that this demographic bolus of first time home buyers will be able to afford a new home. I call this the “Tiffany Effect.” Just like most new couples cannot afford an engagement ring that comes in that distinctive blue box, only the very fortunate few will be able to afford a new home. The massive demographic push that will come in years 2020-2024, will increase housing demand but it won’t be as strong as some of my bullish friends in the housing community are betting on.

Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987.