Today the US Census Bureau released the data on new home sales for the month of August 2016.http://go.usa.gov/3tUud As I predicted in my article of April 23, 2016 (“Time For New Home Sales To Show Growth”

https://loganmohtashami.com/2016/04/23/time-for-new-home-sales-to-show-growth/

, new home sales are showing strong growth, 20.6 percent above the August 2015 estimate of 505,000.

Year over year data line in my article back in April.

Updated year over year data now.

From Calculated Risk:

http://www.calculatedriskblog.com/2016/09/a-few-comments-on-august-new-home-sales.html

The Census Bureau report states:

http://go.usa.gov/3tUud

“Sales of new single-family houses in August 2016 were at a seasonally adjusted annual rate of 609,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.6 percent below the revised July rate of 659,000, but is 20.6 percent above the August 2015 estimate of 505,000.

Despite the facts that US demographics do not support a strong demand thesis and new homes are very expensive, we are still seeing in 2016 the first year since the recession with solid growth in new home sales without a very low bar.

Recall that in 2013, the Taper impacted demand and higher mortgage rates soften post June data.

In 2014 we saw the biggest miss in new home sales in modern day history even though rates were low.

In 2015 new home sales grew roughly 15%, but since the bar was set so low in 2014, the actual numbers were still dismal. A correction in builder stocks started last June, gave a great entry point in Jan of 2016.

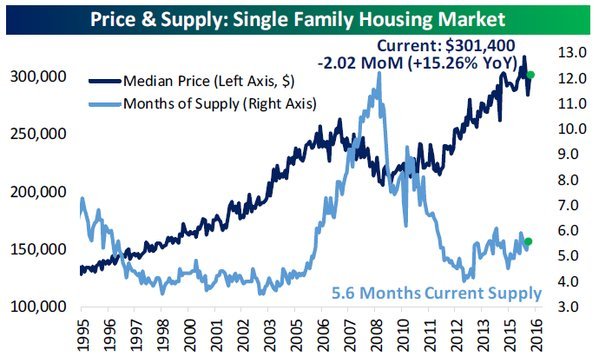

Now in 2016, we are seeing the first real growth in new home sales in this cycle. A big part of this growth is due to the fact that the median home sales price is falling. You may recall from my article on predictions for 2016, I stated that if median new home sales prices cool down or decline, we could see much higher new homes sales. That is exactly what is happening right now

From Doug Short:

https://www.advisorperspectives.com/dshort/updates/2016/09/26/august-new-home-sales-down-to-7-6-month-over-month-better-than-forecast

If new home sales to get to 675K -775K range it will be because more smaller homes are in the mix of sales. We saw growth of over 8% in sales from homes in 200K-300K range.

If we see higher mortgage rates of 4.25% – 4.50% , this could dampen sales, as happened previously.

From Doug Short:

However, with all that said, 2016 is showing the best housing demand data we have seen in this cycle. As we can see below there was a good monthly supply of homes at the start of the year and even with today’s 4.6 monthly inventory print, inventory is sufficient for growth. In fact, inventory today is higher than it was from 1999-2005 when sales where booming due to better demographics and unqualified buyers getting exotic loans.

A must follow on twitter

@georgepearkes

The best aspect of today’s report?

Single highest print of sales in this cycle had a upward revision today!

Whistle!

I will be speaking at 2016 Americatalyst: Fast Forward,October 30 – November 1st in Austin, Texas.

My panel will be called WITHERING HEIGHTS: House and Rent Price Projections and will include these speakers.

HOSTED BY

TONI MOSS, CEO, AMERICATALYST LLC and EUROCATALYST BV

TIM SKEET, Senior Advisor, INTERNATIONAL CAPITAL MARKETS ASSOCIATION | ICMA

FEATURING

DOUG BENDT, SVP of Research and Product Development, RENTRANGE

MARK FLEMING, SVP and Chief Economist, FIRST AMERICAN FINANCIAL CORPORATION

LOGAN MOHTASHAMI, Senior Loan Manager, AMC LENDING GROUP

ALLAN WEISS, Founder and Chief Executive Officer, WEISS RESIDENTIAL RESEARCH

http://www.americatalyst.com/content/2016-americatalyst-fast-forward

Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his own facebook page https://www.facebook.com/Logan.Mohtashami