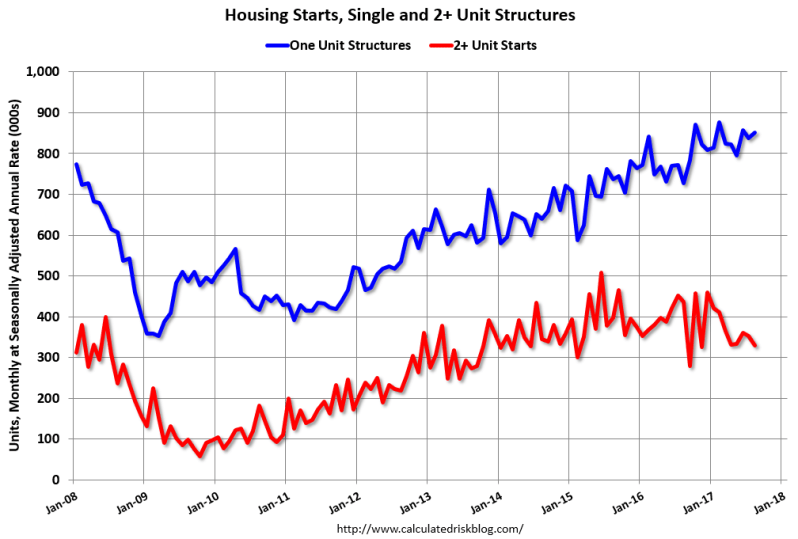

The slow and steady growth in housing starts continues with today’s Census report showing 1,180,000 housing starts in August. This number is down slightly due to the positive revisions of the previous month’s numbers but we did get a good permit print up 5.7%. While variations in housing starts numbers can be wild on a month to month basis, the trend for 2017 is clear. We have growth in single family construction but the boom in multifamily construction has slowed while construction of single family residences is contributing more to the total growth.

August ‘17 building permits up 5.7% to 1,300,000 (annualized). Starts down 0.8% to 1,180,000. http://go.usa.gov/3uKjC #Census

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,180,000. This is 0.8

percent (±9.6 percent)* below the revised July estimate of 1,190,000, but is 1.4 percent (±8.9 percent)*

above the August 2016 rate of 1,164,000. Single-family housing starts in August were at a rate of 851,000;

this is 1.6 percent (±9.0 percent)* above the revised July figure of 838,000. The August rate for units in

buildings with five units or more was 323,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted

annual rate of 1,300,000. This is 5.7 percent (±2.0 percent) above the revised July rate of 1,230,000 and is

8.3 percent (±1.6 percent) above the August 2016 rate of 1,200,000. Single-family authorizations in August

were at a rate of 800,000; this is 1.5 percent (±1.3 percent) below the revised July figure of 812,000.

Authorizations of units in buildings with five units or more were at a rate of 464,000 in August.

As we can see in the chart below, the deviation of single family starts from multifamily starts began in earnest with the expiration of the 2015 multifamily tax credit expired, which front loaded demand for multifamily construction but had little effect on single family construction. We have also seen so far a peak in the rate of growth for rent inflation too which can explain the lack of building growth in the 2 unit structure space.

From Calculated Risk:

http://www.calculatedriskblog.com/2017/09/housing-starts-decreased-to-1180.html

Multifamily construction is down 23% year over year but single family construction is up 17.1%, year over year. Single family construction is up 8.9% year to date so you can clearly see what is impacting total growth.

Although we had a good print on permits this month this has been the weakest housing start cycle ever, working from the lowest levels ever as well. This is due to the overhang from the over investment from the housing bubble years. This is also due to unit sales for new homes are still historically low as well. Until we get better demographics for housing, growth in starts will remain slow and steady.

From Doug Short

https://www.advisorperspectives.com/dshort/updates/2017/09/19/new-residential-building-permits-august-permits-bounce-back

Curious how 3 hurricanes in the Atlantic (Harvey, Irma, and now Maria) will affect housing? (Hopefully hurricane Jose doesn’t hit land)

For some time builders have been complaining about a lack of labor and we are deep into this economic expansion with over 153,000,000 people working. Prior to the hurricanes, we had legitimate demand for more construction labor outside the cycle norms. We have not reached the peak in the number of construction employees we had in the previous cycle, even though total construction spending has reach 2007 levels.

From Fred: https://fred.stlouisfed.org/search?st=Construction+

I would keep a close eye on housing start data and construction employment, job openings, wage growth, lumber prices and hours worked over the next 12 months.

Logan Mohtashami is a financial writer and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his own facebook page https://www.facebook.com/Logan.Mohtashami