The Census report on last month’s new home sales showed weaker than expected headline numbers. Remember though that headline data for new home sales and housing starts are always wild, month to month. The 4-month trend is a better way to gauge the direction of sales. Today’s report showed solid positive revision, bringing the numbers to a slight decrease in monthly supply to 5.9 months. We missed expectations of 626,000 new home sales coming in at 618,000. The November and December revisions were so strong I had to do a double take. It pays to wait for revisions until one makes any bold statements on the direction of sales for the year.

My 2018 prediction for new home sales was this

“For this new year I expect to see 2%-5% growth in new home sales that could go higher if the median sales price remains stable and the trend of building smaller homes continues”

https://loganmohtashami.com/2017/12/31/2018-economic-housing-predictions/

So far we have 2% growth.

From Calculated Risk:

http://www.calculatedriskblog.com/2018/03/a-few-comments-on-february-new-home.html

From Census: https://www.census.gov/construction/nrs/pdf/newressales.pdf

New Home Sales:

Sales of new single-family houses in February 2018 were at a seasonally adjusted annual rate of 618,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent (±13.3 percent)* below the revised January rate of 622,000, but is 0.5 percent (±16.6 percent)* above the February 2017 estimate of 615,000.

Sales Price:

The median sales price of new houses sold in February 2018 was $326,800. The average sales price was $376,700.

For Sale Inventory and Months’ Supply:

The seasonally-adjusted estimate of new houses for sale at the end of February was 305,000. This represents a supply of 5.9 months at the current sales rate.

We had positive revisions and a positive trend so far in 2018. If our expectations don’t go above slow and steady growth in this sector, then the numbers will not disappoint. I was expecting monthly supply to be lower than 5.9 months , the headline print did come in a tad light but all in all a decent report.

From Fred:

https://fred.stlouisfed.org/series/HSN1F

From Fred:

https://fred.stlouisfed.org/series/HSN1F

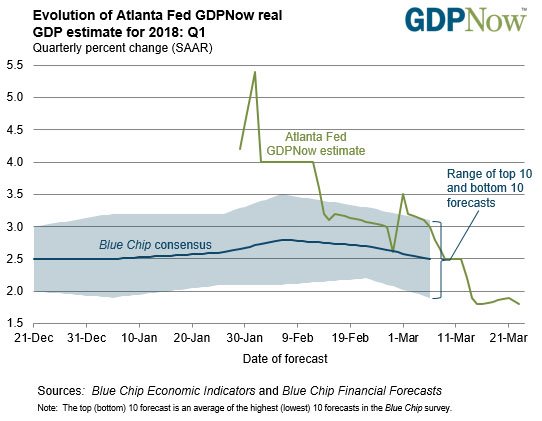

On a side GDP Note, shocking I am telling you! Q1 GDP is coming in lighter than some had hoped. Typically we see the American bear trolls roll this chart out because it has a 1 handle on it but this has pretty much been the norm for this cycle. In fact I specifically mentioned this in my 2018 Prediction Article to watch out for

GDP:

“The rate of growth for population and productivity has been falling for decades, even while being at cumulative highs. This is why we have been seeing lower GDP growth. This is also why I have predicted that GDP would have a 2 handle in the past few years. The notion that the U.S. could have 4%-6% sustained growth is unrealistic. Because Q1 always comes in soft, it makes it even more difficult to have achieve 3% total growth for a year.”

https://loganmohtashami.com/2017/12/31/2018-economic-housing-predictions/

Atlanta Fed@AtlantaFed

Logan Mohtashami is a financial writer and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his own facebook page https://www.facebook.com/Logan.Mohtashami

About Logan Mohtashami: