Before I go into this conversation, I am, of course, going to have my own take on the topic, but now that we can shade the grey lines for recession due to Covid19, I thought it would be a good time to take a look back at what happened last year and where we are at today. The NBER recently stated that the recession ended in April of 2020. Everyone will have a different take on this, and that is fine and healthy; that is what makes a marketplace. Don’t forget, getting out of the recession and into a recovery phase are two different things. This aspect was addressed in the AB recovery model, especially with the jobs data. Let’s not forget, April was the mother of all low bars to work from on the economic data side.

From the NBER:

Determination of the April 2020 Trough in US Economic Activity

https://www.nber.org/news/business-cycle-dating-committee-announcement-july-19-2021

Now the updates will be on charts going out. Of course, this drives many people mad, but in the end, the data needs to confirm the premise.

Let’s go back to April 7th, 2020. I wrote about America Is Back economic model giving people a set of data lines to track to show people the recovery will happen in 2020, timed with certain dates in the year. As you can imagine, people thought I was crazy and then some. However, when I wrote about the Chaos Theory and the Butterfly Effect For HousingWire on February 3rd, 2020, it was a heads up on what could happen if the virus came to the U.S. and make sure not to overreact to it because we had no recessionary data in January and February of 2020. In fact, the February data was solid as housing data broke out to go along with growing retail sales, better PMI data, high levels of job openings, and low unemployment claims even up to March 12, 2020.

Now I retired that model on December 9th, 2020 as the last metric was hit, which was the 10-year yield heading back to 1%. You can read the last article on this topic here.

https://loganmohtashami.com/2020/12/09/america-is-back-the-final-economic-update/

A few these said back on April 7th, 2020.

While I didn’t believe we could get to 1.33% -1.60% in the year 2020. The final confirmation did come in 2021. Even though the 2021 forecast range was 0.62% – 1.94% for this year on the 10-year yield, we must get to 1.60%. At this point, if you’re still a recessionary bear, you’re well behind the curve of what just happened.

This is economic art at its best, Vangoh, Monet, etc. etc.

April 7th, 2020

“I believe the months of April and May are going to tell an epic story of America’s start in defeating this virus. If we do this right and document the cause and effect of our efforts, future generations will be able to look to this period in time for how to handle a global pandemic.“

“My faith in America winning has never let me down because I always believe in my people and country. I can tell you now, this virus isn’t changing my view on that.”

Most of you know me as a housing economic person. However, the number 1 thing that I am passionate about is economic cycles, even more than housing. We just had the longest economic and job expansion in history with over 487 crisis events and millions of bad recession calls, mostly from stock traders who are obsessed with gold. The number 1 goal for me was the make sure to document the recession and recovery.

Of Couse, Covid19 was a extreme shock and had nothing to do with traditionally economic cycles. However, the rules still apply. The Leading economic index bottomed out in April as it should have, and we left every American bearish person in the dust after that.

From AdvisorPerspectives:

https://www.advisorperspectives.com/dshort/updates/2021/07/22/cb-leading-economic-index-continued-rise-in-june

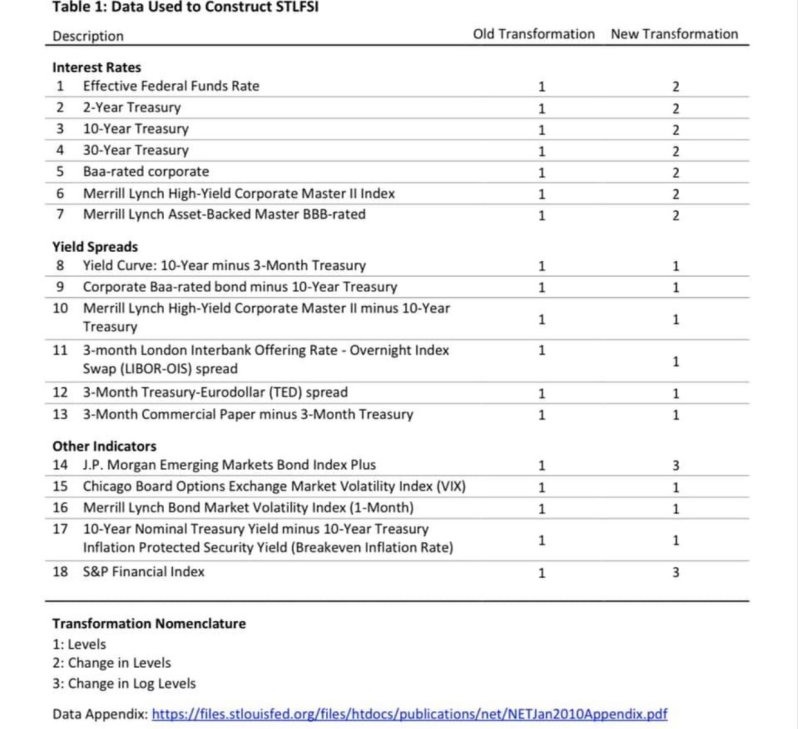

The St. Louis Financial Stress index, which always gets disrespected by stock traders, was your early clue that the economy was in recovery as well. Don’t forget this going out.

From Fred:

https://fred.stlouisfed.org/series/STLFSI2

Being stuck in 2008 mode didn’t end well for certain people. However, it did; they were all long stocks; trust me, they all made money. Some of us made more than others, but still, everyone made money. Be careful listing to stock traders on networks, Twitter, Facebook, chatrooms. They’re mostly hedged long no matter how much they hate the economy or the Federal Reserve.

Going out if you’re looking for my housing economic work, all of it will be on HousingWire.com from now on as I won’t be writing much on housing here.

https://www.housingwire.com/author/logan-mohtashami/

NBC interview on 7/22/2021 on the state of the housing market.

Economics done right is very boring!

Always be the detective, not the troll.

Economic models keep us in line; they always force us to look at data day in and day out. There is no end, no beginning, no beginning of the end or end of the beginning. We just have to roll with all the live variables and take them in every day. This isn’t the most exciting thing I know, but it’s the right way to do it. Obviously, Covid19 was an extreme variable, but economic models keep you on the path when you fall back on them to show people the light!

What I wrote on April 10th, 2020

For those who are looking for the bright side of light. This is for you.

These are dark times. But even in dark times, we are preternaturally prepared to see the light at the end of the tunnel. We learned in the human physiology class that the photoreceptors of the human eye could detect a single photon of light. While it may not be until nine or more photos hit the retina that we perceived light, we detect before we can perceive. Likewise, if we are diligent, we will be able to identify the return of hope and light coming back into the American economy before it is perceived by all those poor masked souls around us.

Have a great weekend, everyone!

Logan Mohtashami is a Lead Analyst for Housing Wire, financial writer, and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami, now retired, spends his days and nights looking at charts and nothing else.