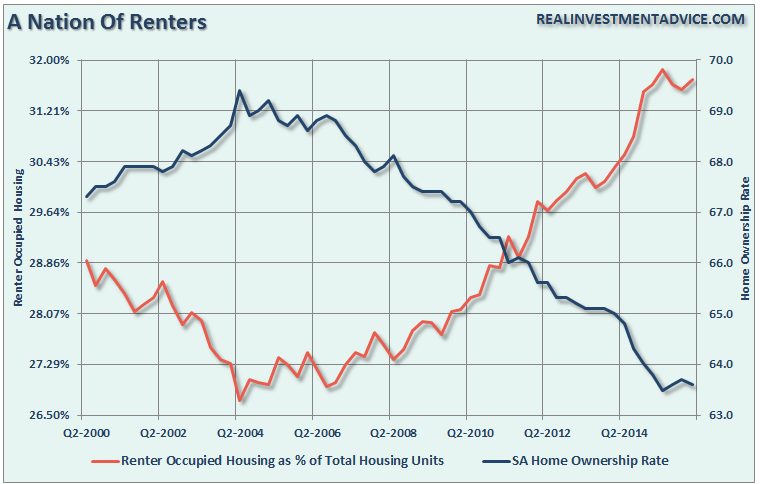

Home ownership in the US peaked in 2004 at 69.2%. Since then we have seen a steady decline in ownership rates that began to flatten to the low 60s% around 2010. Today in 2016 we have hit a cycle low of 62.9%

For years, I have said that the real home ownership rate (number of households that can afford the debt of a mortgage) is between 62.2% – 62.7%. Because the US census counts homeowners who are delinquent on their mortgage payments as owners, until they officially lose the home, this number is artificially inflated. US demographics for the current economic cycle heavily favors renting over owning. This is because we have huge numbers in the age range of 17-29 (living at home or renting ages) and in the range of 49-65 years. The US will remain demographically challenged for home ownership until around 2019 when are youngsters will enter the home purchasing years of 28-42 years of age.

In my 2010 Housing Predictions for 2011 Article I outline the rationale for why we were going to be a renting nation for the next decade.

“The longer term consequences of an unstable residential real estate market may be more serious than just the destruction of individual wealth. The ideal of middle class home ownership may be at stake. The census bureau reported a 7% decline in national rental vacancy rates in 2010, along with an overall decline of 0.7% in home ownership rates compared to a year ago. There were fewer “organic” buyers, more renters and more investment buyers in the market in 2010 and I expect this trend to continue into 2011. Are we at the beginning of a sociological movement away from middle class home ownership and towards a cultural split between the investment property landlords and their renters both of whom may have less personal investment in neighborhood security, local schools and shared public facilities compared to primary homeowners.”

Mortgage purchase application demand is only back to 1998 levels today.

From Calculated Risk:

http://www.calculatedriskblog.com/2016/07/mba-mortgage-applications-decrease-in_27.html

And new home sales are only 0.2% above 1963 levels. When adjusted to population, new home sales are down 41.8% from 1963 .

From Doug Short:

http://www.advisorperspectives.com/dshort/updates/New-Home-Sales

From Lance Roberts:

Census:

Click to access currenthvspress.pdf

If you follow the housing pundits, you know that many of them over the last several years kept trying to call the bottom of home ownership rates – but it kept going down. Every year they said it was the bottom. [Hi Mark Zandi, how you doin’?]. This is because they only had wishful thinking instead of a data-based rationale for their calls. But if one follows an actual data based methodology, as I do, then we can project that the US is just 0.02% away from hitting the percentage of home-ownership that I predicted to be the real rate back in 2010 (just saying).

The key take away is that we are now near the end of the decline in home-ownership. If the rate goes below my 62.2% then I will admit to having missed something– but the demographic and economic data suggest that home-ownership rates will not fall below 62.2% before our demographic profile switches to favor ownership over renting.

Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987.