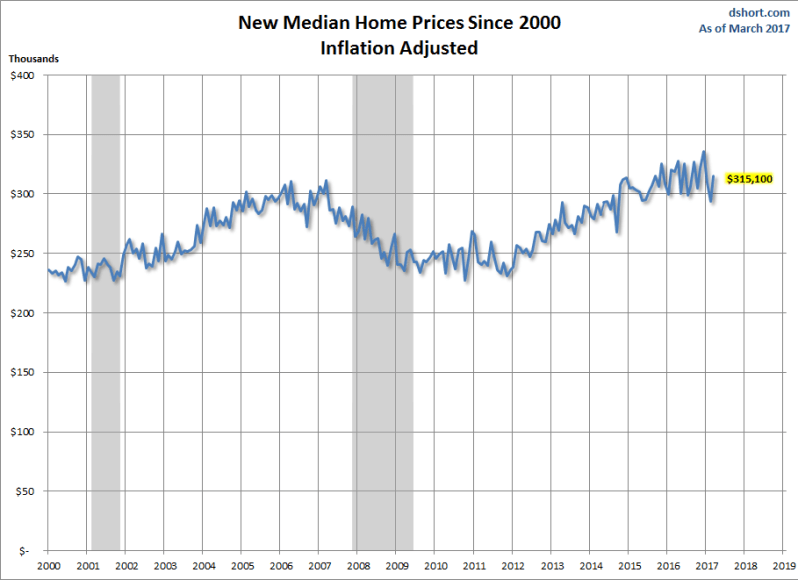

The trend of new median home sales prices since 2000 is perhaps the most important metric to follow for housing economics. The data released today for this sector is looking good!

From Doug Short

https://www.advisorperspectives.com/dshort/updates/2017/04/25/march-new-home-sales-jumps-surprises-forecasts

In 2014, sales for new homes dramatically missed estimates during an up cycle with interest rates near record lows. The miss in sales was largely due to to the fact that builders were pushing bigger and bigger homes and not providing mid-tier and lower end, more affordable options. People forget that in 2014, mortgage rates were falling from the start of the year. Earlier in the cycle, I predicted that if the median sales price for new homes cooled off then we could expect to see more growth in sales since we were already working from the lowest levels ever recorded in U.S. history. Since late 2014, the median sales price for new homes has gone nowhere. This is a very bullish trend for housing but doesn’t get the attention it deserves. This trend implies that more smaller homes are in the sales mix. If you want to see unit sales really pick up we need to have even more, less expensive homes to the mix.

On the other hand, American home size continues to increase which isn’t a bullish sign for in the long term.

The Census Bureau reported that there were 621,000 new home sold in March, which is a 15.6% increase year over year. The year over year comps were easy to beat for the first 3 months of the year. So, expect harder year over year comps for the rest of the year now.

March 2017 new home sales 621,000 (SAAR), up 5.8% from Feb 2017 and up 15.6% from March 2016 http://go.usa.gov/3tUud #Census

As always, context is key. Sales are still historically low, which gives it legs to run higher. Slow and steady is the way to call it, not record breaking demand!

New home sales are still trending at a low 1/10th of the total home sales from the more typical 1/6th of total home sales. I wouldn’t get too concerned about not having growing demand until we start a calendar year at 675K – 775K total new home sales. This year we started at 563K, so were are still 2 years away from a high 6 or 7 handle on that metric.

The economic environment of over 146 million people working and mortgage interest rates below 4.5% with monthly supply still higher than the previous cycle gives new home sales legs as it’s still working at a historic low level of demand.

From Fred

https://fred.stlouisfed.org/series/MSACSR

From Doug Short

https://www.advisorperspectives.com/dshort/updates/2017/04/25/march-new-home-sales-jumps-surprises-forecasts

Logan Mohtashami is a financial writer and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his own facebook page https://www.facebook.com/Logan.Mohtashami

Hello Logan,

Being that you’re an excellent real estate blogger, you will probably like reading my latest blog post:

“Why Investors Should Generally Ignore Real Estate Predictions”

Here’s the link: http://www.realestatetiming.com/speech-at-lareic.html

All the best – I enjoy your articles on real estate

Robert Campbell http://www.RealEstateTiming.com