For those who follow me, it is not a secret that in the past I have been critical of specific individuals that believe in Modern Monetary Theory (MMT). But since it is taking up so much real estate in the public debate as of late, I feel compelled to weigh in on the good, bad and ugly of the current MMT movement with my three favorite tools –math, facts, and data.

First and foremost, although I would never fully align myself with proponents of the MMT movement, their original thesis that federal debt is not a problem for us, happens to be one that I agree with. Federal debt has been the economic boogie man for politicians, mostly from the right, for decades. Federal debt is about to take off like it has never before. In the years 2024-2057 will be facing mandatory payouts more massive than we have ever seen as a country. I am very comfortable in saying that, despite this, the U.S. should be exceptional. We have the biggest economy in the world, the most prominent military, 140 trillion-plus GDP, financial assets and a growing prime-age labor force. We have the capacity to own this debt. The dollar won’t collapse, and we will always be treated fairly in the bond market, unlike other countries.

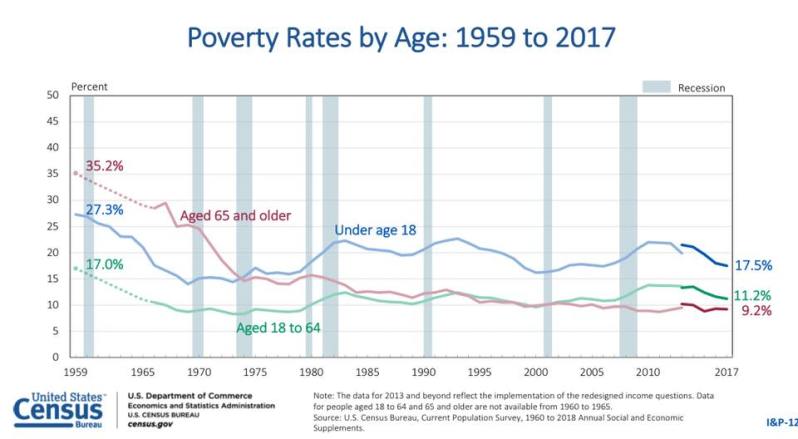

But! – The fact that the dangers of federal debt have been greatly exaggerated for political purposes does not mean that the rest of the MMT economic claims are valid in context to the problems with climate change. One of the main ways that MMT falters is in misidentifying the issues. The MMT platform has been lumped into a massive policy concept called the Green New Deal (GND). The proponents of the GND are setting off twitter wars with republicans, democrats, and moderates who are labeling them as extremists. This back and forth names calling in the political space is replacing any meaningful debate on the real, problem of climate change. Some of the significant issues that are the focus of the GND do exist but are not of the scale that the MMT proponents say. For example, recently Stephanie Kelton, a prominent MMT name in the current debate, said on CNBC that 50% of the people in the United States are living in poverty and we are facing a debilitating student loan crisis. In fact, the official poverty rate given by the Census Bureau is 12.3% and falling.

From Census: https://www.census.gov/library/publications/2018/demo/p60-263.html

For that 12.3%, poverty is a severe problem that should be addressed by the public sector – but government solutions that address the issue of poverty in that 12.3% are vastly different then what would be devised to address poverty in 50% of the population. Galvanizing our resources to solve a non-existent problem will most certainly suck up all the discussion on how to pay for all of it. The facts as they are, are telling, the issues are real. However, exaggerating does not help anyone and can hurt getting a practical solution.

With regards to the debilitating student debt crisis, while it is true that student loans are the fastest growing segment of U.S. household debt, we need to look at who holds this debt and if those holders can own that debt. Seventy percent of defaults are from students who attended for-profit universities (think Trump University and similar university’s that offer useless degrees) and college dropouts. It makes sense that if you don’t finish your degree program, or get suckered into a useless degree program, you will be less likely to be able to pay the debt payments. The graph below shows that millions of Americans have significant student debt– BUT! It does not show you that the vast majority of borrowers can own this debt, and are living economically stable lives not living in a crisis state. Students with the most significant debts, such as post-graduate law or medical students, go on to well-paying jobs. Should we invest in programs to help students? Certainly. Innovative programs that help college students graduate and go on to productive and lucrative jobs would benefit the entire economy. Better regulation of expensive diploma mills might also help. I am also in support of some form of free college and crazy in love with the idea of massive trade school policies. With current technology, it would not be difficult for the government to partner with existing public institutions to offer free online classes to any and everyone with access to a computer. I would even support a government write-down of some debt based on need – especially if it allowed the student to return to school and finish their job training or degree. The majority of college debt holders have a debt of $20,000 and under. It is roughly half that amount for those who took debt on and never finished college. A college degree is still the best insurance for a stable financial future. Student debt is a severe problem for those who took debt on and never finished school or got a worthless degree. It is not a crisis in need of a massive government bailout of all student loan debt. Again, my chickens, it might be raining, but please don’t confuse that with a falling sky.

From: https://www.valuepenguin.com/average-student-loan-debt

From BLS: https://www.bls.gov/

From Doug Short: https://www.advisorperspectives.com/dshort/updates/2018/10/22/household-incomes-the-value-of-higher-education

Another overhyped problem in the MMT platform is the lack of jobs. A number of the MMT proponents (not all of them) have the notion that millions of Americans are looking for but not finding work since the great recession, thus making it necessary to involve the government in creating jobs for these people. It seems honorable enough, but let’s look at the actual data. The national unemployment rate is currently around 4%, and we are in the longest job expansion ever recorded in U.S. history of 100 months and counting. We also have the most significant job openings ever recorded in U.S. history at 7,340,000 and are soon to be in the longest economic expansion ever recorded in U.S. history. We have over 157,000,000 people working with the civilian labor force under 164,000,000;

Is the scope of the unemployment problem in the U.S. so great that we need a government jobs guarantee program to be bundled with our war against climate change? Really? We have enough real problems in the country. For those few, in this booming economy, who cannot find work, I support some kind of government step up. A stable job in the foundation for a stable life. Work is the lifeblood of a healthy economy and a healthy country. There will always be those among us who have a hard time finding work. A partnership between government and the private sector that offers either classes or job experience to these hard cases so they can move into the private sector full-time is something I fully support. We don’t need a job to guarantee program, just some tweaking to what we already have in place in many areas. For those Americans who can’t get hired due to failing a drug test, lack of even a high school education or a criminal record I would always support a JG plan because for me a Job’s guarantee plan is really designed to prevent long-term unemployment. But let’s not mix this in with our efforts to fight climate change.

From Doug Short:

https://www.advisorperspectives.com/dshort

When I heard about the Green New Deal, I was optimistic. I hoped it would be an economically sound roadmap for how the U.S. could get back on track to markedly reducing carbon emissions by converting the electrical grid to run on clean, renewable sources, electrifying transportation and promoting energy efficiency. The transformation of the whole economy from fossil fuel based to clean energy based is an enormous undertaking – a more significant project than building the atom bomb, going to the moon and fighting world war two all together in a 10 year time span, It would be very, very difficult, but that doesn’t mean it can’t be done in a reasonable time frame. Most of the technology that we need for this transformation already exists – it just needs to be implemented nationwide. Because this very critical initiative is being lumped in with a bunch of other, frankly non-urgent MMT policy, it is being tainted with the nonsense on how are we going to pay for all this. This green initiative is too important to let the MMT boogeymen own it. Reasonable people (politicians and other policymakers at every level) need to stand up and take ownership of the problem of climate change, or it will be left to carnival doomsayers.

For MMT policies to be successful, we all need to stick to the facts and stop exaggerating and name calling. Those who want to implement these policies should focus their energies on educating the presidential candidates so they can speak to these issues during their campaigning. Twitter wars with Paul Krugman and Larry Summers might be entertaining, but they do not move the ball down the field in terms of helping the public and policymakers understand these issues. We need real political victories to change the trajectory of climate change, and that means changes to the Senate and the election of a presidential candidate who supports transformational policies. And these can only be won an old-fashioned way of one vote at a time. Creating enemies from the left, right and center only prevents this from happening. Take a look at how Joe Weisenthal and Mattew Boes talk about MMT without getting into dysfunctional name calling tweet rants.

Logan Mohtashami is a financial writer and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his own facebook page https://www.facebook.com/Logan.Mohtashami