First and foremost, Coronavirus is a horrific human tragedy. Forget about the economics of it first, we want to wish China nothing but the best in tackling this deadly event.

Second, the Coronavirus will have an economic impact, companies will start to warn about this event. You can’t have the 2nd biggest economy in the world be on lockdown without an effect.

I talk about that very thing here in an article I wrote for HousingWire a few weeks ago.

From Boeing to Brexit: 7 major storylines that could send mortgage rates even lower

Third I don’t believe Gold Bug stock traders on twitter who have been wrong about America since 1913 or this expansion since March of 2009 are the people you should be listening too now.

Fourth, Don’t feel bad for these people either, none of them were short the market in any meaningful way. This group just likes to ice skate uphill and anything that floats of death, destruction, crash, and recession. They run to like a bear to honey.

Fifth, King Dollar, yes, the dollar is getting stronger again. This will have some economic impact. However, I remember a day when these guys used to always say this country is broke, and the dollar is on the verge of collapse. Remember, the dollar makes it’s most significant % run before the first rate hike. It typically doesn’t do much after. Even with this record-breaking job and economic expansion, never for one second was the dollar on the verge of collapse.

https://www.dailyfx.com/us-dollar-index

My issue with the Coronavirus Gold Bugs on twitter is that these are the same people that in 2019 were saying the recession is so near because of

1. ISM under 50

2. Repo Recession Man

3. Leading Economic Indicators Are Falling

4. Non-Manufacturing ISM is falling

5. Single-family starts are negative

6. 18 trillion-plus of negative yields

7. The Inverted yield curve

8. The Atlanta Fed GDP Q4 first print came in a 0.3%

Listen, I can spend all day writing the host of reasons that was given that we would be currently in a recession as I write this.

2 things happened recently.

First: The stock market hit all times high, but don’t worry about these Gold Bugs, none of them were actually short the market heavy.

Second: Pretty much all the economic data above turned positive. I mean everything that the 2nd half 2019 bears screamed about has turned positive. So, now they have moved on the Coronavirus. The Coronoavrisu and Boeing together will impact growth. However, don’t jump the gun on the crash thesis. Be patient, let the data and the information come to you first before streaming live 24/7 updates of the Coronavirus.

Here are the 2020 Charts updated

1. ISM is positive now with Markit PMI as well. Nothing spectacular is going on here, but in a recession, this index would be going a lot lower now.

Philly Fed today, don’t put too much weight on how high this move was today, just know that it got better.

2. Repo Recession Man reminds me a lot of the I survived the 3% 10-year yield

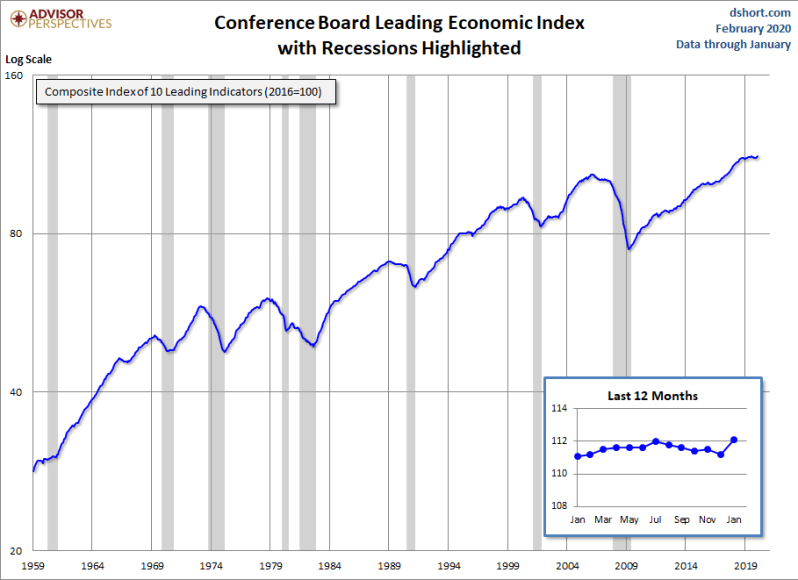

3. Leading Economic Indicators

For those who follow me on Twitter, you know how desperately I have tried to warn the LEI down trend group that they were going to be early. It didn’t get through to them, and for that, I apologize because I wasn’t a good enough teacher. LEI stopped the recent slowdown and has gone positive. Remember, housing starts! Permits at cycle highs today and PMI data look just a tad better.

4. Non-Manufacturing ISM stopped going down.

Both are now trending higher. Nothing spectacular going on here, but it wasn’t the recession that bears made this out to be again back in 2019.

You get my drift here. Maybe The Coronavirus is the final nail in the coffin, and the Americans bears get their loved glory American crash. Or perhaps this is a short term event like the Boeing situation and the 2nd half 2020 looks better?

Time will give us the Answer for sure. However, are these the people you really want to listen to on twitter. A cult is a cult, especially when they’re older in age, they’re too much invested in their ideological views to change. So, I don’t want them to change.

However, for you younger people. Is this what you want to be remembered as, a dying gypsy economic relic of the past wishing for nothing but bad data so their golden rain dance of a recession will come true. Think about how your kids and grandkids will think of when you pass off to the afterlife. You only live once, make it count.

Regarding the stock market and the bond market. Yes, we are overdue for a correction. It’s been a while since we had a legit correction pullback. With where the 10-year yield is and headline concerns, you would expect such a response. However, don’t make the next pull back a paranoid we told you so, the recession is coming, ya ya ya moment again.

Many times have we seen a pullback to hear this group tell us this won’t end well.

Regarding the bond market. I fall back to my 2020 Forecast article because 2020 is the 4th time in this record-breaking expansion that the 10-year yield went below 1.60% and no recession. Wink Wink

2020 Economic & Housing Forecast

https://loganmohtashami.com/2019/12/28/2020-economic-housing-forecast/

“Any stock market sell-off, correction, or near-bear market can drive money into bonds short term. With many headline-driven risks in play next year, don’t ignore the lower end of my bond market channel just yet. If growth picks up, even just a tad next year, then I don’t expect we will stay under the 1.60% level too long if we see headline risk. This has been the reality in this record-breaking expansion; short-term headline-driven events take us below 1.60% on the 10-year yield. However, we don’t stay there too long because we were never going into recession. Slowing growth took yields lower, but slower growth doesn’t necessarily mean an imminent recession. The failure to understand this has been a plague for the American Recession Bears.”

Three different events drove yields under 1.60% on the 10-year treasury in this cycle.

1. 2012 European Bond market scare caused some to speculate that Spain would default.

2. 2016 Brexit scare, that was overkill.

3. 2019 Trade war tap dance and the inverted yield curve

Don’t presume a 1 handle on the 10-year yield is a recession, have a diverse economic model for your recession thesis, and this will prevent you from jumping the gun on your recession thesis.

Here is mine, updated 7 days ago, and today it looks even better.

Recession Red Flag Update: 2020

https://loganmohtashami.com/2020/02/13/recession-red-flag-update-2020/

Logan Mohtashami is a financial writer and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his Facebook page https://www.facebook.com/Logan.Mohtashami and is a contributor for HousingWire.