Back on February 3rd of this year, I introduced the Chaos Theory and the Butterfly Effect. This was due to all the news that was coming out on the virus on an article for HousingWire.

“In chaos theory, the butterfly effect refers to the idea that due to the interconnectedness of all things, a small event can result in large effects on a nonlinear, dynamic system.

The butterfly effect gets its name from the metaphor that even small swirls of air caused by the flapping of a butterfly’s wings can change the path of a tornado, even though the system is far removed in space and time from the initial event.

In many ways, we see this theory manifest in the U.S. bond and stock market – a dynamic system that is prone to the influences of distant perturbations.

Case in point, a virus outbreak among an urban population of a distant country may lead to a lower rate of growth in the economy in 2020. But it could also lead to a lower 10-year yield and thus lower mortgage rates for the housing market. “

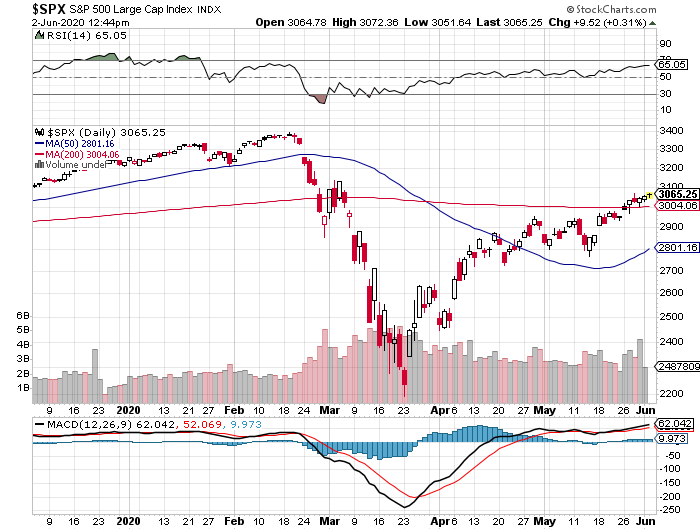

Our economy has crashed due to the virus and lockdown protocols, but one thing has happened, which might provide a false security blanket. The stock market has rallied big time since the recent lows.

I usually don’t talk about stocks outside my investment calls on twitter on $TOL. (Which I sold out of After The most recent earnings report). I know people are puzzled that the stock market has rallied so much as the economic data is still bad. Only the U.S. housing market through purchase application data has had a real V shape recovery recently.

So, what are the two critical data lines that have helped the stock market short term outside the significant fiscal and monetary operation?

The dollar spike has come down, and the St. Louis Financial Stress Index has almost come back down to zero.

Components of the St. Louis Financial Stress Index

Trust me I am not trying to hate on the stock market folks, I have had a great year financially trading stocks. I am just trying to bring some economic reality to what is ahead of us.

Returns as of the close yesterday.

Recently I gave an update on the 5 things I need to see to get America off the AD stage (After the Disease) to the AB Stage ( America is Back). We were making some progress.

However, don’t mistake the uptick in the stock market that we don’t need to be vigilant and have a whatever it takes attitude against this fight vs. Covid19.

By the end of this week, over 43,000,000 jobless claims have been filed. Over 30,000,000 Americans will have lost their jobs. Over 105,000 Americans have died due to Covid19, and now we have riots all over the country with a pandemic virus still killing us.

I was mindful of the virus with the Choas Theory and the Butterfly Effect statement back on February 3rd, 2020.

Now again, I stress that Chaos is still here, and we have so much work to do as a country to get us back to the BC ( Before Coronavirus).

We need de-escalation leadership now and a 100% focus on getting the economy back on track to get people working again and making a living. We need not press the breaks on fiscal and monetary stimulus but think of more ways to help every American who has suffered.

All the progress we have made recently can be reversed if escalation leads to more riots, less fiscal stimulus, and a significant uptick in new cases forcing the question on how we handle that.

Remember, we always win because we are still one nation, one family, one team. Once we lose that aspect, our greatest strength as a country gets weaker.

Logan Mohtashami is a financial writer and blogger covering the U.S. economy with a specialization in the housing market. Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1987. Logan also tracks all economic data daily on his Facebook page https://www.facebook.com/Logan.Mohtashami and is a contributor for HousingWire.